The latest edition of the IEA’s Future of Geothermal Energy report offers a comprehensive analysis of the geothermal energy market and its vast potential. It delves into both established (flash steam and binary power plants) and emerging technologies (EGS and CLGS) designed to harness this promising and versatile renewable resource, which remains underutilized despite its significant capacity for electricity generation, heating, and cooling.

While geothermal has been part of energy systems for over a century, its global impact has remained limited. Today, however, the industry stands at a pivotal moment attracting growing attention from governments, financial investors, developers and analysts. This renewed momentum is being driven by advancements in technology, alongside cost reductions and innovative financing models, which are expanding geothermal role in global energy systems. Moreover, expertise from the oil and gas industry, particularly in subsurface knowledge, drilling, and large-scale project management, is helping to unlock deeper geothermal resources and further drive down costs.

In this article we will explore the key insights from the IEA report, covering:

- The existing potential of geothermal energy

- Technological next-generation Innovations and their technical potential

- The potential of next generation geothermal

- Synergies between O&G industry and geothermal driving geothermal cost reduction

- Trends in policy, investment, and costs

- Policy recommendations to overcome development bottlenecks

1.The growing potential of geothermal energy

Geothermal energy stands out as a highly versatile, clean, and reliable source of power with immense potential for meeting global energy needs. Geothermal can generate electricity, produce heat, and store energy continuously, ensuring consistent operation year-round. In 2023, global geothermal capacity achieved an impressive utilization rate of over 75%, far exceeding the performance of wind and solar PV. Thanks to their very high-capacity factor, geothermal power plants give a great contribution to grid stability by providing flexible operations that help balance electricity demand and integrate other renewable sources. Additionally, geothermal can supply a steady flow of low- and medium-temperature heat for various applications, including residential, industrial, and district heating.

Analysing the current market, conventional geothermal energy represented approximately 0.8% of global energy demand in 2023, amounting to 5 exajoules (EJ). However, global geothermal power capacity for electricity generation saw a remarkable growth of nearly 40% over the past decade, reaching nearly 15 gigawatts (GW) by 2023. While in terms of heat and cooling, geothermal energy currently satisfies around 1% of global building heat demand, with a relatively limited role in industrial applications. Over 60% of this geothermal heat (1.1 exajoule [EJ]) is consumed in residential and commercial buildings, through ground source heat pumps. Geothermal heat pumps, primarily deployed in countries such as China, the United States, Sweden, Switzerland, Germany, France, Canada, and Norway, have been promoted through various incentives and public programs. These technologies harness easily accessible low-temperature geothermal resources for heating and cooling, yet their potential remains largely underutilized in many regions. District heating systems represent the second-largest application of geothermal heat, accounting for roughly one-third of its global final consumption. Iceland stands out, with over 90% of its district heat production fuelled by geothermal energy, driven by particularly favourable geological conditions. Globally, China leads as the largest user of geothermal district heating, while in Europe, geothermal contributes less than 3% of the total district heating capacity.

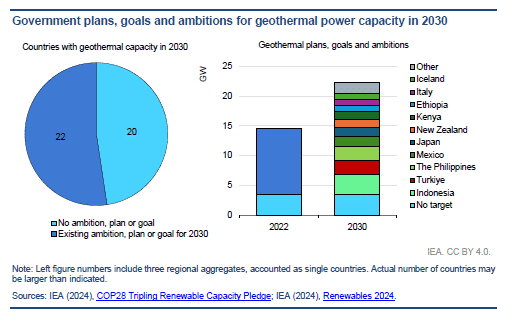

Regarding future forecast global capacity expected to increase by nearly 50% to 22 GW by 2030 and to almost 60 GW in 2050 in the IEA Stated Policies Scenario. Considering the increasing geothermal competitiveness and more favourable policy scenario beyond 2030 the IEA’s Announced Pledge Scenario demonstrates that capacity could exceed 80 GW by 2050, driven by faster project implementation and new drilling permits.

Meanwhile, in the heating sector, geothermal heating is projected to double by 2030 and triple by 2050 in the Stated Policy Scenario, with China contributing to nearly 70% of the global increase in direct use. In the Announced Pledges Scenario, the generalization of effective derisking policies, streamlined permitting procedures and faster implementation of policy goals could boost new geothermal heat developments 50% by 2030 compared with the Stated Policies Scenario.This growth highlights the huge untapped potential of geothermal energy in low to medium heat sources. Estimates suggest that geothermal resources from sedimentary aquifers at depths up to 3 km and temperatures above 90°C could provide approximately 320 terawatts of potential energy, enough to fulfil the electricity and heating needs of regions like Africa, China, Europe, Southeast Asia, and the United States. For lower temperature resources, the potential for geothermal increases about tenfold.

1.1 Geothermal energy and critical mineral extraction

Another significant potential application of geothermal energy lies in the extraction of critical minerals, such as lithium, from geothermal brine, which emerges during geothermal energy production, holds significant potential beyond power generation, offering valuable minerals that can be extracted for commercial use. By combining geothermal energy projects with critical mineral extraction, the economic feasibility of such ventures is enhanced. Both sectors face high upfront costs, substantial early-stage risks, and shared permitting requirements, but integrating these projects can boost returns by diversifying revenue streams. Though no commercial geothermal lithium projects are yet operational, several are progressing towards construction, including pilot and demonstration plants, primarily in the United States and Europe. If all planned geothermal projects are realized, they could produce approximately 47 kt/year of lithium by 2035, covering 5% of global lithium demand. Europe alone could generate over 10 kt/year, which would meet 10% of EU electric vehicle sales. Integrating geothermal and lithium extraction offers several advantages, such as streamlined permitting, diversified revenue, and reduced risk, making these ventures more attractive to investors while ensuring long-term project resilience.

Explore our geothermal solutions and discover how we’re driving the energy transition!

2. Technological next-generation Innovations and their technical potential

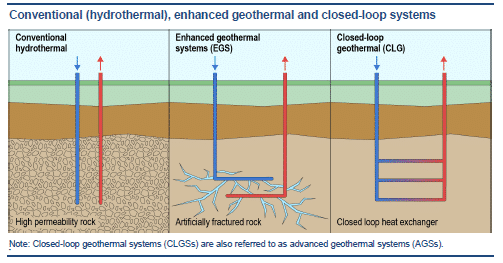

Geothermal developers are exploring “reservoir-independent” methods, which move beyond traditional reliance on natural hydrothermal reservoirs. These approaches, including Enhanced Geothermal Systems (EGSs) and Closed-Loop Geothermal Systems (CLGSs) also called Advanced Geothermal Systems (AGSs), are currently being tested through pilot and demonstration projects.

Enhanced geothermal systems (EGSs) expand existing geothermal reservoir capacity or create new reservoirs by enhancing hot-rock permeability, typically by drilling deep wells and opening up natural fractures in the rock and/or creating new ones through Hydraulic, Thermal or Chemical stimulation.

EGSs significantly broaden geothermal energy’s potential by enabling energy extraction in areas with high subsurface temperatures but insufficient fluid volumes or natural rock permeability.

CLGSs, on the other hand, offer the advantage of fewer site-specific requirements, making them applicable in a wide range of locations. These systems involve drilling deep, large, artificial closed-loop circuits that act as underground heat exchangers. A fluid is circulated through these closed loops and heated by the surrounding hot rocks through conductive heat transfer, without chemically interacting with the rocks themselves. CLGSs are also characterized by high output predictability, low water consumption, and reduced risks of induced seismicity compared to EGSs.

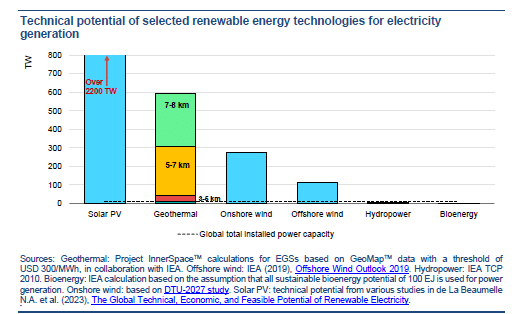

The technical potential based on these next generation geothermal systems is vast. EGS and CLGS overcome the dependency on natural reservoirs inherent in conventional geothermal projects, enabling the exploitation of geothermal heat in virtually any location. Concerning Electricity potential EGSs alone could provide nearly 300,000 exajoules (EJ) of thermal resources within 8 km of depth. This is equivalent to 600 TW of geothermal capacity operating for 20 years, nearly 2,000 times that of conventional geothermal systems. Thanks to these breakthrough innovations geothermal global technical potential for annual electricity generation could be estimated at 4,000 petawatt-hours (PWh), which is about 150 times current global electricity demand. The United States is seen as having the largest technical potential for enhanced geothermal capacity, accounting for roughly one-eighth of the global total. In terms of heat, geothermal extraction from sedimentary aquifers at depths of 0.5-5 km and temperatures over 90°C could provide over 250,000 EJ globally at a levelized cost of less than USD 50/MWh, equivalent to 320 TW sustained for 25 years. Even with less widely available geothermal heat above 200°C, the potential remains significant, estimated at 15,000 EJ, enough to meet nearly 500 years of global industrial heat demand for temperatures below 200°C. The United States holds the largest geothermal heat potential at 90°C, solidifying its position as a leader in the global geothermal sector.

3.The market potential of next-generation geothermal energy

Based on the technical potential assessed in regions where next-generation technologies can be supported with investments and strong development the global market potential is estimated in over 800 gigawatts (GW) of electrical capacity of by 2050 and heat production could exceed 10,000 petajoules (PJ) per year for district heating and industrial applications. As said this potential is concentrated in specific markets, including China, the United States, and India, which together account for nearly 75% of the global market. To unlock this opportunity, global investments would need to surpass USD 1 trillion by 2035, rising to USD 2.8 trillion by 2050, with the majority allocated to electricity generation. At its peak, next-generation geothermal investments could reach nearly USD 200 billion annually around 2035, driving clean technology deployment.

3.1 Next-generation geothermal for electricity

Next-generation geothermal energy for electricity generation shows significant promise, with first-of-a-kind Enhanced Geothermal Systems (EGS) projects currently estimated to cost around USD 14,000 per kilowatt (kW). However, through a learning-by-doing approach, costs are expected to decrease rapidly over time. With strong and sustained support for innovation and development, construction costs could drop by up to 80% by 2035. The Levelized Cost of Electricity (LCOE) for early-stage projects is currently over USD 230 per megawatt-hour (MWh), but this is expected to fall dramatically, with projections of around USD 50/MWh by 2035 and USD 30/MWh by 2050 in a low-cost scenario. By 2035, next-generation geothermal could be as cost-competitive or even more affordable than other clean dispatchable technologies, including solar PV, wind, and natural gas with carbon capture, across several major regions. The market potential for next-generation geothermal is heavily dependent on how much costs can be reduced. In the low-cost case, the global market potential could reach 120 GW by 2035 and over 800 GW by 2050, providing up to 8% of the global electricity supply by mid-century. This would be in addition to the projected 80 GW expansion of conventional geothermal by 2050.

3.2 Next-generation geothermal for heat

Next-generation geothermal has the potential to become a highly competitive source of heat for large industrial plants and industrial parks if construction costs decrease significantly. In a low-cost scenario, where upfront costs for a next-generation geothermal heat plant fall to around USD 1,150/kWth by 2035 due to reductions in drilling expenses, the levelized cost of heat could be as low as USD 5/GJ. By 2050, further decreases in upfront investment costs, along with rising CO2 prices, could make next-generation geothermal competitive with both fossil fuel-based heating systems and industrial heat pumps. This technology could be especially advantageous for industries that require process heat in the 100-200°C range, such as paper and chemical production, cement manufacturing, and food processing. While the market potential is promising, there are significant challenges, including high investment costs and long planning timelines. The typical 1-4 years required for planning before a geothermal plant becomes operational could impact investment decisions, especially for companies aiming to recover their investments within a 10-15 year timeframe.

Unlock the power of geothermal energy! Explore our innovative solutions!

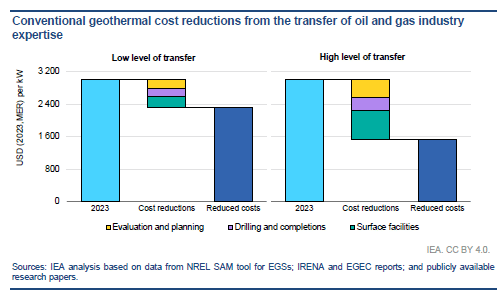

4. Synergies between O&G industry and geothermal driving geothermal development and cost reduction

The oil and gas industry can play a pivotal role in enhancing the cost-effectiveness of geothermal energy. Up to 80% of the investment required for geothermal projects relies on capacity and skills that are already common in the oil and gas sector. There are several overlapping competencies between the two industries, including subsurface evaluation, modelling, drilling, and surface operations, which are essential for both conventional and next-generation geothermal technologies. Many geothermal industry workers come from oil and gas backgrounds, further facilitating this knowledge transfer. Key areas of overlap include project evaluation, planning and management, drilling and completion, surface facility construction, and operations monitoring. Currently, around two-thirds of every dollar invested in conventional geothermal operations is shared with the oil and gas industry.

Leveraging this expertise could significantly reduce geothermal costs. For instance, the cost of providing district heating through conventional geothermal systems is nearly USD 3,000/kW, and Enhanced Geothermal Systems (EGS) costs have already dropped to about USD 15,000/kW in 2024, significantly lower than in recent years, largely due to the adoption of drilling and completion techniques honed in the oil and gas industry. In addition, applying a high number of practices from oil and gas operations could potentially reduce costs by nearly 15%. Scaling up surface practices through modular, repetitive design and improving drilling efficiencies by widely applying oil and gas technologies could provide a further 35% cost reduction. For EGSs, widespread knowledge transfer from the oil and gas industry, combined with additional research support to acquire and improve reservoir data, processing, and modelling during the evaluation and planning stages, could reduce costs by approximately 10%. In total, it is estimated that significant knowledge transfer and productivity gains from the oil and gas industry could lead to a reduction of up to 50% in the costs of conventional geothermal technologies, while next-generation technologies could experience a nearly 80% reduction in costs.

4.1 Workforce and skills

The oil and gas industry currently employs around 12 million people globally, a significantly higher number compared to the geothermal sector, which provides approximately 145,000 jobs. Many of the skills developed in the oil and gas industry are directly transferable to the geothermal sector, with minimal additional training required, mainly focused on familiarizing workers with the specific health, safety, and environmental risks associated with geothermal operations. As geothermal energy grows, total employment in the sector is expected to reach 1 million jobs by 2030. As a result, it is estimated that around 40% of oil and gas workers displaced in the advanced policy scenario (APS) could transition to the geothermal sector, contributing to workforce development and the expansion of geothermal technologies.

4.2 Financing Geothermal Projects

Another way in which the O&G industry could play a major role in driving geothermal development is through investments. Oil and gas companies have increasingly turned to joint ventures as a strategy to enter the geothermal market, allowing them to share project financing and risk while contributing their technical expertise and drilling equipment. Alternatively, to meet sustainability targets and maintain control, these companies may also directly fund geothermal projects through equity investments. Additionally, the oil and gas sector can help reduce the cost of capital for high-risk geothermal ventures by leveraging its established presence in credit and debt markets. This could include forming partnerships with commercial banks, issuing bonds, or raising capital through other traditional financing methods.

In the next section, we will examine the current state of government support for geothermal energy, focusing on the policies and frameworks that are driving this growth, as well as the challenges and opportunities related to cost dynamics, investment, and job creation.

5. Geothermal energy trends in policy, investment, costs and job creation

5.1 Government support, incentives and remuneration

Despite gaining recognition on the global stage with 42 countries expected to have installed geothermal power capacity by 2030. Geothermal energy is currently included in the renewable energy goals of only 22 nations for the same year. Among those with the most ambitious targets are Indonesia, the Philippines, and Turkey, which are leading the way in geothermal power development. On the heating and cooling front, only a few countries have incorporated geothermal energy into their government plans and ambitions as a viable solution.

In terms of policy support, while over 100 countries have established frameworks for solar and onshore wind energy, fewer than 30 have specific policies for geothermal power. These policies generally fall into two main categories: risk mitigation schemes, which aim to reduce resource-related risks before the construction of power plants, and remuneration schemes, which address the financial risks associated with plant operations. Currently, 27 countries have introduced risk mitigation measures, such as grants for drilling, subsidized loans, and insurance schemes to cover resource uncertainties. Additionally, resource assessments in countries like France, Germany, and the Netherlands play a crucial role in reducing these risks. For revenue security, geothermal power plants typically benefit from feed-in tariffs or long-term contracts like corporate power purchase agreements (PPAs), ensuring stable income streams throughout the plant’s lifecycle.

5.2 Cost dynamics, investment challenges and job growth potential

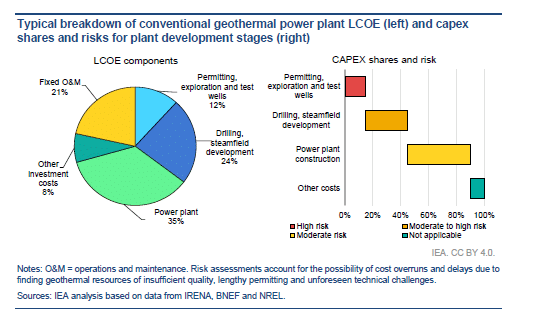

The costs associated with conventional geothermal power generation are site-specific, with generation costs for plants built between 2010 and 2023 ranging significantly, from USD 40/MWh to over USD 240/MWh. These costs depend on factors such as the quality of the geothermal resource and rock permeability. As a result, global average annual generation costs have typically ranged between USD 60-80/MWh in the past decade. The need for custom designs to suit specific locations prevents the geothermal sector from achieving economies of scale, maintaining relatively stable costs despite the growing interest in the technology. Initial investment, which accounts for roughly 80% of electricity generation costs, is largely spent on plant equipment and construction, which makes up 40-60% of the total investment. These costs vary depending on the plant’s size and complexity. Larger, high-temperature plants generally have the lowest costs per megawatt, while smaller or more complex systems such as binary or hybrid plants tend to be more expensive. Drilling wells for production and injection, along with steam field development, makes up 30-45% of total investment, and permitting, resource exploration, and test-well drilling add another 10-15%.

Regarding investments in geothermal energy, it has emerged that they are on the rise, with both public and private firms driving most geothermal power generation projects. These entities account for over 70% of the installed, under-construction, and planned geothermal capacity. Notably, oil and gas companies have a stake in approximately 7% of geothermal projects, either partially or fully owning them, with most of these projects being state-owned. Despite the increasing role of private firms, state-owned enterprises continue to play a critical role, contributing to nearly 30% of global geothermal project development. Governments, oil and gas companies, and utilities are actively seeking investment opportunities in geothermal energy. If deep cost reductions are realized for next-generation geothermal technologies, total investment in the sector could reach USD 1 trillion by 2035 and USD 2.5 trillion by 2050. At its peak, annual geothermal investment could exceed USD 140 billion, surpassing current global investments in onshore wind. Geothermal potential as a dispatchable clean energy source has also attracted interest from beyond the energy sector, including technology companies seeking reliable power solutions for rapidly growing data centre demands. In 2023, geothermal power and heat investments surpassed USD 47 billion, making up over 5% of total renewable energy investments globally. The lion’s share of these investments, over 95%, went toward heating applications such as ground-source heat pumps, with China accounting for over 70% of global geothermal investments. Outside China, geothermal investments have been steadily increasing since 2022, following a period of decline between 2014 and 2021, largely due to supportive policies in the United States and Europe encouraging renewable heat solutions.

In addition to its economic challenges, geothermal energy also holds great promise for job creation. The global geothermal industry currently supports approximately 145,000 jobs, with the potential to increase employment to 1 million by 2030. Around 140,000 of these jobs are directly linked to geothermal power development and operations worldwide. To meet the demands of an expanding geothermal sector, further investment in university degrees, apprenticeships, training programs, and the establishment of regional and international centres of excellence will be crucial. Notably, the manufacturing of geothermal equipment accounts for nearly 25% of all geothermal-related jobs, while the construction of conventional geothermal power plants, which is a labour-intensive process, represents almost 50% of total geothermal employment.

5.3 Investment in next-generation geothermal innovation

Investment in next-generation geothermal technologies is crucial for achieving economies of scale and improving cost competitiveness. Since 2021, most of the innovation funding has been concentrated on a select few pioneering companies focused on Enhanced Geothermal Systems (EGS) and Advanced Geothermal Systems (AGS), such as Fervo and Eavor. Oil and gas companies, recognizing the synergies between their industry and geothermal energy, have contributed nearly USD 140 million to the development of these next-gen systems. Venture capital (VC) and private equity firms have also been major players in financing geothermal innovations. However, to realize the full potential of these technologies, the geothermal sector needs a robust market.

In this final paragraph, we will highlight the key challenges facing the geothermal sector and explore the proposed policies that could address these issues.

6. Policy suggestions to unlock bottleneck to developmentsts and job creation

Stronger policy frameworks and targeted incentives are crucial for unlocking the full potential of geothermal resources and accelerating their integration into the global energy mix. The report identifies key challenges across several areas, including the establishment of an enabling ecosystem, securing adequate financial support, advancing research and innovation, and developing a skilled workforce in the geothermal sector. It also proposes a range of policies aimed at addressing these challenges and driving the sector’s growth.

6.1 Designing an enabling ecosystem:

- Targets and Roadmaps

Challenges: Geothermal energy is included in only 9% of nationally determined contributions (NDCs) as a mitigation option, limiting sector development.

Policy: Incorporate geothermal in energy planning and set specific targets, roadmaps, and implementation plans to boost investor confidence. - Resource Assessment

Challenges: Inadequate and non-standardised subsurface data hinder accurate project risk assessment, delaying development.

Policy: Improve data quality and establish open-access geothermal data repositories. - Permitting and Institutional Capacity

Challenges: Lengthy permitting processes, often taking 5-10 years or more, increase costs and delay projects.

Policy: Streamline legal frameworks, simplify administrative procedures, and establish geothermal-specific permitting rules. - Social acceptance and community engagement

Challenges: Community concerns over geothermal projects mainly focus on environmental impacts, such as drilling, well stimulation, noise, and seismic risks.

Policy: To enhance social acceptance, policies should prioritize early community engagement, transparency, and clear communication. Policies should include local employment quotas, infrastructure improvements, and reduced fees for local energy use to foster community support.

6.2 Financial Support through schemes and incentives for Geothermal Projects

Financial support is crucial for mitigating the predevelopment risks associated with geothermal projects, such as high exploration and drilling costs. Governments can help by offering risk mitigation schemes and providing incentives for the purchase of geothermal power or heat, which could include subsidies or long-term purchase agreements. Currently, at least 20 countries have implemented financial support mechanisms to encourage geothermal project development, making it a more viable and attractive investment option but still some challenges remain and new policies are needed.

- Remuneration schemes for geothermal power generation

Challenges: Without long-term remuneration schemes, financing geothermal electricity projects can be challenging.

Policy: In emerging markets, fixed tariffs or premiums can provide long-term revenue certainty. In more developed markets, corporate power purchase agreements and competitive auctions could help stabilize revenue. - Remuneration scheme for Geothermal district heating

Challenges: District heating networks for geothermal energy are capital-intensive and face competition from fossil fuels.

Policy: Policymakers should promote expertise in heating and cooling planning, support heat mapping exercises, and utilize concessional financing. - Remuneration scheme for Geothermal heat pumps

Challenges: The higher upfront costs and long payback periods of geothermal heat pumps can deter.

Policy: Financial incentives, such as grants and tax credits, can reduce installation costs, while supporting geothermal networks delivering heating to multiple buildings can help achieve economies of scale. - Funding for Research and innovation

Challenges: The lack of dedicated funding and infrastructure for research and innovation in geothermal energy.

Policy: Expanding geothermal-specific R&I programs through public-private partnerships and specialized research facilities could drive down costs and support technology transfer from the oil and gas sector. - Programs initiatives for Jobs and skills

Challenges: The geothermal sector needs a skilled workforce of engineers, geologists, and drillers, but there is a decline in enrolment in relevant academic programs and limited geothermal training.

Policy: Governments and industry should collaborate to create dedicated geothermal programs and specialized training initiatives, like those in the U.S., and invest in capacity-building for decision-makers, particularly in emerging economies.

Conclusion

In conclusion, geothermal energy stands at the forefront of the renewable energy transition, offering immense untapped potential for both power generation and heating applications. The key takeaways are:

- Geothermal energy is a stable and programmable renewable energy source with the highest capacity factor, contributing significantly to grid stabilization.

- Technological advancements and growing interest position geothermal to become a key player in the global energy mix.

- Despite its potential, challenges remain, including high upfront costs, long planning timelines, and the need for substantial investments.

- The oil and gas sector can provide valuable support, leveraging its expertise and financial resources to help overcome these barriers.

- Continued collaboration and innovation among governments, policymakers, investors, the geothermal industry, and the research community will be essential to unlock geothermal energy’s full potential and drive its widespread adoption in the coming decades.

Want to learn more? Read the full report here.

Want to know how our ORC solutions can help you unlock geothermal energy potential? Discover our innovative approach!

For more information, contact us here. Let’s partner together!