Europe’s district heating sector stands at a decisive moment of transformation. Serving nearly 80 million citizens across 19,000 networks, district heating and cooling (DHC) systems have become central to Europe’s ambitions for energy security and climate neutrality. In 2023, the continent’s heat supply reached 548.6 TWh, with 44.1% already sourced from renewables and recovered waste heat — clear evidence of accelerating decarbonization.

Decades of reliance on imported fossil fuels have exposed Europe’s vulnerability to energy shocks, pushing policymakers and industries alike to seek cleaner, more resilient alternatives. Industrial heat pumps are now emerging as one of the most promising solutions, enabling large-scale integration of renewable and waste heat into district energy systems. Beyond reducing emissions, they enhance local energy independence and help stabilize energy prices — two priorities emphasized by recent crises.

In this article, we will explore the latest findings from Euroheat & Power’s “Market Outlook 2025” report, examining how industrial heat pumps are reshaping the European district heating landscape. We will focus on:

- The heat pump revolution in district energy

- Market data & current landscape

- Complementary technologies: e-boilers & flexibility

- Waste heat recovery: the untapped resource

- Geothermal

- Market outlook 2030: growth projections

- District cooling: the overlooked opportunity

- Policy drivers & financing

The heat pump revolution in district energy

Unprecedented growth: heat pumps lead renewable integration

Across Europe, industrial heat pumps are rapidly becoming the foundation of district heating decarbonization. In 2023 their contribution reached 6,489 GWh, marking an impressive 44% increase year-on-year, which confirms the technology’s maturity and growing competitiveness as utilities seek to reduce fossil fuel dependency and meet EU climate objectives.

The potential for further expansion is impressive. 84% of Europe’s population is connected to sewage networks, offering an estimated 150 TWh/year of recoverable heat, while data centres could supply an additional 200 TWh/year, making the harnessing of these urban heat sources crucial for achieving the EU’s renewable energy targets and improving energy resilience.

Germany is currently setting the pace, with over 50 large-scale heat pump projects in planning or construction, which together represent approximately 900 MW of thermal capacity, of which 80 MW are already operational. Forecasts indicate this figure could climb to 6 GW by 2030, reflecting the country’s ambitious drive toward low-carbon heating.

As heat pumps increasingly integrate with district energy systems, they not only supply renewable heat but also support power-to-heat flexibility—absorbing excess electricity during low-price periods and converting it into affordable, clean thermal energy.

Technology fundamentals

Industrial heat pumps elevate low-temperature heat from various ambient sources—such as rivers, lakes, shallow geothermal, and wastewater—to the higher temperature levels required for district networks. By capturing and upgrading this thermal energy, they transform otherwise wasted resources into a steady, decarbonized heat supply.

A leading example is the RheinEnergie project in Cologne, one of Europe’s largest river-water heat pump installations. The 150 MW system, drawing energy from the Rhine River, will supply around 50,000 households with heat by 2027. Using a natural refrigerant and operating up to 110°C, it demonstrates how advanced heat pump technology can deliver city-scale renewable heating while supporting RheinEnergie’s goal of climate neutrality by 2035.

Market data & current landscape

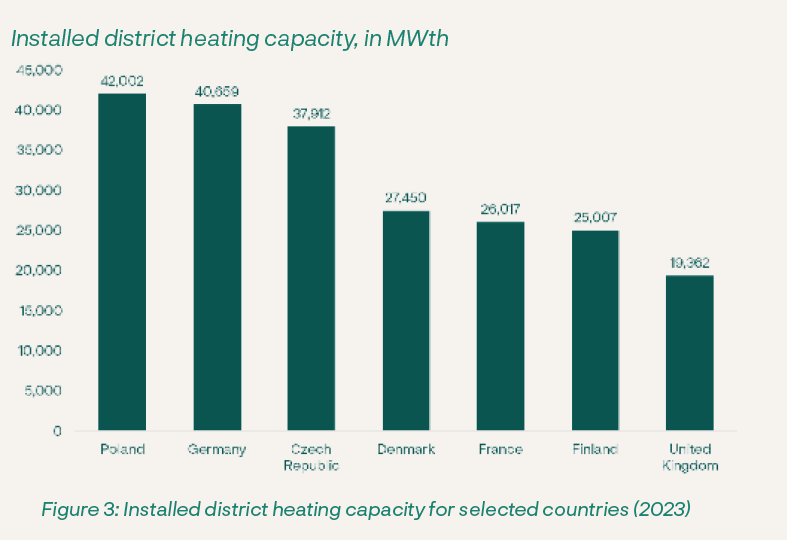

Over the past five years, Europe’s district heating networks have expanded by 9.7%, adding around 14,000 km of new distribution infrastructure and confirming the sector’s strategic role in the transition toward low-carbon energy systems. Germany and France led this growth, extending their networks by 6,754 km and 1,551 km respectively, while more mature markets such as Denmark and Finland continued to grow steadily, adding 3,000 km (10%) and 1,038 km (6.7%). In 2023, total installed capacity remained stable at around 309 GWth, reflecting sustained investment despite slightly lower heat demand due to mild weather and energy efficiency improvements. Capacity and connectivity vary significantly across Europe: Poland leads with 42 GWth, followed by Germany (40.7 GWth), the Czech Republic (37.9 GWth), Denmark (27.4 GWth), France (26 GWth), Finland (25 GWth), and Austria (12 GWth). Expanding household connections continue to demonstrate the vitality of these systems—Germany’s district heating served 6.4 million households in 2023, adding 31,200 new buildings, while France connected an additional 2,200 buildings, marking 6% annual growth. Looking ahead, network expansion is expected to accelerate further under EU climate and energy policies such as the Fit for 55 package and through the increasing integration of renewable and waste heat sources, enhancing the resilience, sustainability, and decarbonization potential of Europe’s district heating sector.

Complementary technologies: e-boilers & flexibility

Electric boilers: the perfect partner for variable renewables

Electric boilers (e-boilers) are emerging as a crucial tool for integrating variable renewable electricity into district heating networks. In 2023, they supplied 4,501 GWh, reflecting an impressive 80% year-on-year growth, with Nordic countries—Denmark, Finland, Sweden, and Norway—more than doubling their share thanks to flexible tariffs and low electricity prices. E-boilers capture electricity price arbitrage opportunities, converting excess renewable electricity into heat while responding rapidly to grid conditions.

A prominent example is Helsinki’s Patola facility, operated by Helen. Scheduled to become operational between 2026 and 2027, the plant combines a 20–33 MW air-to-water heat pump with two e-boilers, delivering a total output of 100 MW and producing over 500 GWh annually. This project exemplifies how e-boilers complement heat pumps, providing both decarbonized heat and operational flexibility in a city-scale network.

System integration and grid flexibility

Beyond e-boilers, thermal energy storage (TES) is increasingly recognized as essential for decarbonizing district heating. TES systems decouple heat supply from demand, enabling the storage of excess heat from renewables or heat pumps for later use. This allows networks to shift energy from periods of surplus into daily or seasonal peaks, smooth flow and temperature variations, and integrate multiple heat sources efficiently.

Large-scale TES deployments in Europe include above-ground steel tanks, underground reinforced tanks, and aquifer or borehole storage, providing both daily and seasonal flexibility. By stabilizing network flows and deferring costly infrastructure upgrades, TES not only optimizes operational efficiency but also extends asset lifespans, complementing the role of e-boilers and heat pumps in achieving a fully flexible, renewable-ready district heating system.

Waste heat recovery: the untapped resource

Industrial waste heat: from loss to asset

Industrial and service sector waste heat is increasingly recognized as a valuable resource for district heating. In 2023, waste heat accounted for 4.1% of total district heat deliveries, marking a 20.6% increase from the previous year. Countries with mature district heating systems, such as Sweden and Finland, reported shares of 18.8% and 12% respectively. Aalborg University estimates that, by 2050, optimized scenarios could unlock 337 TWh/year of recoverable heat from industrial sources.

Several projects demonstrate the potential of this approach. In Hamburg, the Aurubis copper production plant delivers 40 MW of thermal energy to the local district heating network, serving 20,000 households through a thermal storage unit operating at 105°C. In Ghent, Belgium, the DuCoop cooperative integrates industrial heat from a soap factory with wastewater, achieving over 138 tonnes of CO₂ avoided since 2021 while providing affordable heating. These examples illustrate how waste heat recovery can reduce emissions, enhance energy efficiency, and foster circular energy models.

Emerging sources: data centers and beyond

Beyond traditional industry, new sectors are beginning to supply recoverable heat. Data centers, hydrogen production facilities, and other high-energy operations generate substantial thermal waste that can feed district heating networks. Capturing this heat offers dual benefits: it reduces energy losses while providing reliable, low-carbon heat to urban areas. Although currently limited in scale, these emerging sources represent a significant untapped potential for cities aiming to decarbonize heating and diversify energy supply.

Geothermal

In parallel, geothermal energy is increasingly representing a fundamental resource for Europe’s district heating landscape. In 2024 alone, ten new geothermal district heating and cooling (DHC) plants were commissioned across the continent—three in Poland, two in the United Kingdom, and one each in France, Greece, Romania, Spain, and the Netherlands—adding roughly 110 MWth of new capacity. By the end of 2024, Europe counted 412 operational geothermal DHC systems, including 308 located within EU Member States. France remains one of the continent’s leaders with 79 active plants, followed by the Netherlands with 33 systems and Romania with 15, two of which in Oradea were commissioned in 2023. The three new Polish installations alone contributed 35 MWth of additional capacity, while Switzerland continues to expand its portfolio, with 11 plants currently under development and three already in operation.

Looking ahead, geothermal district heating is set for further expansion, with around 400 systems currently in planning or development across 27 European countries. Complementing these large-scale systems, geothermal heat pumps (GHPs) are also becoming a basis of the continent’s low-carbon heating mix. In 2024, Europe counted approximately 2.43 million GHPs in operation, providing a combined 37.6 GW of thermal capacity—35 GW from small units (<50 kWth) and 2.6 GW from larger installations (>50 kWth). Together, they delivered around 85 TWh of heat, supplying comfortable and sustainable heating and cooling to more than 10.5 million people.

Market outlook 2030: growth projections

Ambitious targets: 8.5 million new connections

Europe’s district heating sector is projected to growth significantly over the next decade, with forecasts indicating that more than 8.5 million additional households will be connected by 2030 in key markets including Germany, France, Poland, Denmark, Austria, and the Czech Republic. This growth is driven by national climate and energy objectives, as well as heightened attention to energy security and rising energy costs, which have accelerated the transition from fossil-fuel boilers.

In Germany, the federal goal of 100,000 new buildings connected per year far exceeds the current pace of 25–35,000 annually, aiming for a total of 10 million dwellings by 2030. Similarly, France’s current annual growth of 100,000 homes (6%) falls short of the 250,000 homes per year required to meet national targets. Achieving these objectives will require strong regulatory frameworks, long-term policy certainty, and expanded financing mechanisms to support the scale-up of district heating infrastructure.

Large heat pumps are expected to play a pivotal role in this expansion. In Germany, their capacity is projected to reach 6 GW by 2030 and 23 GW by 2045, covering 36% of total district heat output. In Denmark, heat pumps could account for 48% of the district heating supply (20 TWh) by 2040, primarily drawing on ambient heat sources. The Czech Republic is advancing toward a coal phase-out by 2030, transitioning its networks to heat pumps and biomass. Emerging urban heat sources, such as sewage water and waste heat from data centers, further enhance this potential, offering an estimated 150–200 TWh/year of recoverable energy across Europe.

Regulatory landscape and investment requirements

Stable regulatory frameworks and sufficient financing are critical to unlocking these opportunities. Germany faces an estimated €6.4 billion per year in investment needs to decarbonize and expand district heating networks, with €3.4 billion per year of public support required—effectively double current funding levels. The French Heat Fund (“Fonds Chaleur”) demonstrates the impact of targeted support, having mobilized €14 billion since 2009, facilitated over 8,500 renewable and recovered heat installations, and achieved 40–45% CO₂ reductions compared to conventional gas boilers. The fund has proven cost-effective, at €36 per tonne of CO₂ avoided, while deploying 3,500 km of new infrastructure and doubling the share of renewable heat in connected networks since 2013.

Looking forward, Europe’s ability to meet 2030 district heating targets will hinge on replicating such integrated policy and investment models, providing certainty for investors, and accelerating the deployment of renewable and low-carbon technologies, including heat pumps, e-boilers, and waste heat recovery. Only with these measures can the sector realize its full potential in decarbonizing urban heat supply, increasing energy independence, and supporting the continent’s climate objectives.

District cooling: the overlooked opportunity

Rising demand: climate change drives cooling needs

Europe is experiencing a rapid increase in cooling demand, driven by rising temperatures, urbanization, and higher electricity consumption in buildings. In 2023, district cooling networks delivered 3.1 TWh, marking a 10% growth over five years. European cooling degree days in 2024 were 6% higher than 2023 and 20% above the 2000–2020 average, highlighting the impact of climate change on urban energy systems.

District cooling infrastructure is expanding across Europe, with over 200 networks spanning 1,300 km of pipes, reflecting 18% growth between 2019 and 2023 in the five largest markets (Sweden, France, Finland, Norway, Austria). The sector’s growth trajectory is particularly strong in Austria, France, Sweden, and Norway, where sales are expected to rise by more than 70% by 2030. Stockholm offers a prime example: its 250 km network serves over 700 buildings, achieving 66% electricity savings compared to conventional air-conditioning systems while integrating free-cooling sources from the Baltic Sea.

Heat pumps enable integrated heating-cooling networks

Reversible heat pumps enhance the efficiency and flexibility of district cooling systems. They provide year-round performance, supporting both cooling in summer and energy recovery in winter. In Stockholm, heat pumps transfer heat from the cooling return to the district heating network, delivering up to 140 GWh per year. This integration reduces electricity demand, frees up grid capacity, and lowers emissions, while simultaneously improving the overall efficiency and resilience of urban energy systems.

By combining cooling and heating operations, district cooling networks can maximize renewable energy utilization, optimize infrastructure, and mitigate peak loads—demonstrating their strategic role in Europe’s sustainable and climate-resilient cities.

Policy drivers & financing

EU Policy Landscape: from fit-for-55 to heating & cooling strategy 2.0

Following the implementation of the Fit-for-55 package, the European Union has placed heating and cooling decarbonisation at the centre of its 2025–2030 energy agenda. Building on the Action Plan for Affordable Energy (APAE) and the Clean Industrial Deal (CID), the European Commission announced the launch of a revised Heating and Cooling Strategy for early 2026. This forthcoming framework will provide additional tools to accelerate the rollout of clean and affordable heat networks, bridging the gaps left by previous legislation.

The APAE recognises the crucial role of local heat networks in reducing price volatility and strengthening energy independence, while the CID sets the foundation for scaling up clean heating technologies across Europe. Complementary measures—such as the Industrial Decarbonisation Bank, the Innovation Fund, and the upcoming Clean Energy Investment Strategy—aim to mobilise substantial financing for the deployment and modernisation of district heating and cooling systems.

Together, these initiatives mark a shift toward a comprehensive heating and cooling strategy, reinforced by regulatory simplification, streamlined permitting, and reform of electricity tariff structures to reward system flexibility.

Financing mechanisms: de-risking investment

Reaching Europe’s decarbonisation targets will require unprecedented investment—over €1.16 trillion by 2050 in district heating infrastructure alone. Blended finance is emerging as a key mechanism to de-risk these investments by combining public and private capital through loans, equity, guarantees, and technical assistance (TA).

The European Energy Efficiency Fund (EEEF) offers a proven model: roughly 25% of its portfolio has supported district heating and cooling projects. Its experience highlights the importance of risk-sharing tools, long-term financing, and simplified access to State aid. To accelerate deployment, new instruments must ensure multi-annual commitments, flexible electricity tariffs, and reduced permitting delays—creating the stable conditions needed for investors to drive Europe’s thermal transition.

Industrial heat pumps have emerged as the enabling technology for district heating decarbonisation. With a 44% annual market growth and ambitious 2030 deployment targets across Europe, their momentum is undeniable. The technology is proven, economically viable, and fully scalable, making it a cornerstone of future urban energy systems. Yet, its widespread adoption depends on regulatory certainty and robust financing frameworks capable of supporting long-term infrastructure investments.

In this context, Exergy’s X-heat large heat pumps solutions stand out for their capacity to meet the growing demand for large-scale thermal outputs, with market trends now pointing toward systems exceeding 150 MWth. Building on over 15 years of experience in the design and supply of large ORC systems with units reaching up to 30 MWel Exergy has in-house capability to manage high-temperature, large scale heat pump projects. A 30 MWel ORC plant shares many of the same critical components as a 300 MWth large heat pump: high-performance heat exchangers, refrigerants, piping, control systems, and — most importantly — service and maintenance procedures. This deep technological overlap ensures that Exergy’s extensive experience in ORC design and operation directly translates into bankable, field-proven solutions for large district heating applications. Exergy offers utility-scale reliability, optimized performance across multiple operating conditions, and long-term operational excellence, positioning the company as a trusted partner in the decarbonization of urban heat networks.

Explore our industrial heat pump solutions for district energy.

Contact our experts to discuss your decarbonisation pathway.

Read the full report here.

Let’s partner together!