In this article, we’ve gathered key insights from the European Heat Pump Market Report by the European Heat Pump Association (EHPA), focusing on how the market is evolving — especially for industrial heat pumps and district heating applications.

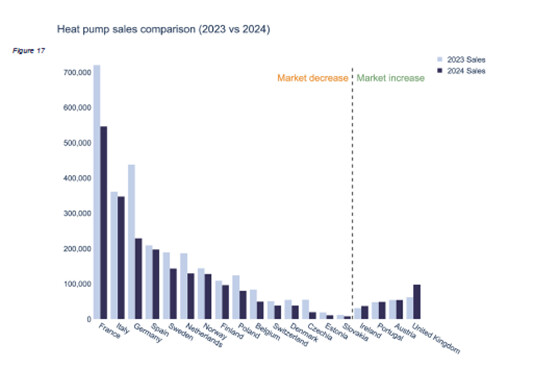

2024 was a challenging year for the heat pump industry across Europe. Around 2.31 million units were sold in 19 countries — a 22% drop compared to 2023. This slowdown has affected manufacturers, workers, and investors throughout the sector.

Some markets were hit harder than others: the Czech Republic saw a sharp 64% decline, and Germany followed with a 48% drop in sales. On the other hand, the UK defied the trend, showing a 56% increase in heat pump sales.

Looking at volume, France led the market with 546,000 units sold, followed by Italy with around 348,000. However, when adjusted for population, Norway and Finland ranked highest — with 48 and 33 units sold per 1,000 households, respectively.

In the next sections, we’ll dive deeper into:

- European Sales Overview

- Technology types and applications

- What caused the 2024 market slowdown

- Strategies to support growth and adoption of industrial heat pumps

- What to expect between 2025 and 2030

1. European Sales Overview

After nearly a decade of growth, the European heat pump market has seen a clear turning point. Following a historic peak in 2022, driven by skyrocketing gas prices and emergency subsidies, the sector experienced a second consecutive year of decline in 2024. Although the drop affected residential and commercial segments alike, it had a particularly noticeable impact on confidence in the large-scale and industrial market — including district heating networks, which rely on policy and infrastructure stability.

While the trend is downward overall, the situation is far from uniform across Europe. National heat pump markets reacted differently to the challenges of 2024. While some countries saw steep declines, others showed resilience or even growth, often depending on the consistency of national policies, energy pricing, and public support.

- Germany, which had taken a leading role in the energy transition, saw a dramatic decline, influenced by shifting regulations, volatile messaging, and a slowdown in consumer and investor confidence.

- Denmark, where lower gas prices undermined the heat pump’s economic edge, saw a –30% drop. Largely due to falling gas prices that undermined the economic case for switching to heat pumps. Even with available funding schemes, the high initial cost discouraged many consumers.

- In Finland, the decrease was more modest (–12%), partly due to market maturity and solid public support. The country’s transition toward electric heating continues, supported by a mature installed base of 1.6 million units, where replacement sales already represent a major segment.

- Austria managed to remain stable (+0.1%). After a slow start, sales recovered strongly in the second half of the year — a sign of how continued public incentives can help maintain momentum even in uncertain times.

- France experienced a notable setback, especially in the air-to-water segment, which lost 124,000 units compared to the previous year. Economic and political challenges, along with high electricity prices, weighed on the market. However, with falling electricity costs and new building regulations (RE2020) starting to take effect, recovery may be on the horizon in 2025.

- Italy showed a modest decline of 3–5%, though results varied between segments. While residential demand softened, industrial and commercial systems — including air-to-water, water-to-water, and VRF — continued to grow at double-digit rates, reflecting stable demand from the business sector, largely independent of incentives.

- The Netherlands saw a sharp 30% sales drop, driven by reduced subsidies and a general slowdown in both residential and commercial projects. Although there was a short-term boost late in the year due to upcoming policy changes, overall demand is expected to soften further in 2025.

- Sweden also experienced a sluggish start to the year, due to excess inventory at the distributor level. However, demand picked up in Q3, and long-term prospects remain positive thanks to high interest in energy renovation and efficiency upgrades. The industry expects that better financing conditions could help re-accelerate growth.

- Norway and Poland both reported market declines. In Norway, the main driver was a drop in electricity prices, which reduced the relative advantage of heat pumps. In Poland, the combination of rising electricity costs, regulatory constraints, and political uncertainty hurt investor and consumer confidence.

- Ireland was a standout in terms of growth per household, climbing to fifth place in Europe by this metric. The country’s consistent and long-term policy support has turned it into a model of successful market transformation, shifting heating demand away from imported fossil fuels.

- The United Kingdom bucked the European trend with a remarkable 56% increase in heat pump sales, especially in the air-to-water segment. Government schemes such as the Boiler Upgrade Scheme played a key role, covering a significant share of installations. The growth was also supported by workforce development, with a 15% rise in certified heat pump technicians. Still, long-term success will depend on further policy clarity and sustained investment.

As of 2024, the total stock of installed heat pumps across 19 monitored countries has reached 25.5 million units. This growing installed base continues to support decarbonisation and energy security efforts, even in a slower sales climate. France leads with around 6.5 million units, followed by Italy with just under 4.2 million.

It’s also worth noting that over 60% of European heat pump sales are concentrated in five countries: France, Italy, Germany, Spain, and Sweden. While this concentration indicates market maturity in some areas, it also highlights the unrealised potential in other regions, especially for large-scale and industrial systems, where adoption still lags behind.

It’s fundamental to highlight that today, the heat pump sector in Europe supports 433,000 jobs, with over 300 manufacturing sites across the continent. Around 73% of heat pumps sold in Europe are made in Europe — and with the right support, this share is expected to grow. Strengthening domestic production and deployment could be a key factor in reducing dependency on imported fossil fuels and in reinforcing the EU’s clean tech leadership.

In the next section, we’ll take a closer look at individual countries to better understand the dynamics shaping each national market.

2. Technology Focus: Types & Industrial Applications

2.1 Heat Pump Technologies: Market Breakdown & Key Trends

The European heat pump market remains dominated by air-source systems, which continue to lead thanks to their relatively low cost, ease of installation, and consistent technical improvements—partly driven by EU Ecodesign requirements. In 2024, the most commonly sold models were reversible air-to-air heat pumps, with 875,000 units sold, followed by air-to-water heating-only models, which reached 668,000 units. These systems remain popular in both new construction and renovation projects, especially in residential applications.

On the other hand, ground-source systems saw mixed results. While brine-to-water reversible models (often geothermal-based) experienced the strongest relative growth (+74%), heating-only variants fell sharply, with sales declining from 135,000 units in 2023 to around 84,000 in 2024 — a 38% drop. This suggests that while interest in renewable, high-efficiency systems remains, installation complexity and higher upfront costs continue to limit widespread adoption.

Another category facing contraction was hybrid heat pumps (air-to-water systems paired with boilers), which dropped by 23% in 2024. These systems, often used in retrofit scenarios where electrical grid limitations exist, offer flexibility and improved energy efficiency. Still, adoption remains modest, and clearer classification in national statistics may affect visibility.

Overall, technology choices remain heavily influenced by climate, building practices, and national regulation. Warmer countries tend to favour air-source solutions for their cooling capabilities, while colder regions with mature infrastructure often lean toward ground-source or centralised systems. In all markets, new high-performance models capable of delivering higher output temperatures are closing the gap with traditional boilers — a crucial advancement for both retrofit projects and industrial settings.

2.2 Industrial Applications: Heat Pumps Beyond Residential

While residential installations dominate the market in terms of volume, industrial heat pumps represent one of the most promising areas for long-term growth — especially in the context of Europe’s decarbonisation and energy security goals. In 2024, reported sales of industrial units grew by 12%, although the data remains partial due to inconsistent reporting from national associations. The EHPA is working to improve data collection for this critical segment.

Industrial and district-scale heat pumps are gaining traction across various sectors due to their potential for high-temperature output, energy efficiency, and process integration. Here are some of the most relevant applications:

- Chemical Industry: Industrial heat pumps are used for polymerisation processes and recovering reaction heat, helping reduce reliance on fossil-fuel-based thermal systems.

- Pulp & Paper: Heat recovery from paper drying and bleaching processes can be reintegrated into production, improving circularity and energy performance.

- Food & Beverage: Applications like pasteurisation, drying, and industrial refrigeration are ideal for large-scale heat pumps, especially when waste heat can be captured and reused.

- Metallurgy: Systems are being used for combustion-air preheating and furnace heat recovery, reducing fuel use and improving plant-level efficiency.

These applications often require customised engineering and are typically integrated into energy service models, where heat or cooling is provided as a service. This model helps reduce upfront investment barriers and makes industrial heat pumps more accessible to a wider range of companies.

Moreover, the use of large heat pumps in district heating systems is on the rise, especially in Nordic and Central European countries, where fossil-free centralised heating is a top priority. New systems are being designed to operate efficiently in colder climates and to integrate with waste heat from industrial processes or renewable electricity, such as solar or wind.

As building regulations tighten and carbon pricing mechanisms like the EU’s Emissions Trading System 2 (ETS2) come into effect, the industrial and commercial sectors are expected to accelerate their transition toward heat pump solutions — not only to cut emissions but to boost competitiveness and reduce energy dependence.

In this context Exergy comes in, with its focus on industrial heat pumps. Exergy has designed the innovative X-Heat industrial heat pump series, which includes both small and large-capacity units, ideal for a wide range of industrial applications and district heating systems.

Want to learn more?

Contact us directly or visit our website to discover how X-Heat can support your decarbonisation and efficiency goals.

3. Causes of Market Decline

The 2024 downturn in the European heat pump market is the result of a mix of macroeconomic pressure and sector-specific challenges. Inflation, high interest rates, and a slowdown in construction activity (with building permits down 1% EU-wide) have reduced consumer spending and delayed new projects. In parallel, policy instability and cuts to national incentive schemes have weakened market confidence. On the energy side, the normalization of gas prices after the 2022 spike has reduced the short-term competitiveness of heat pumps, especially where electricity remains heavily taxed. Misinformation and doubts about performance further discourage adoption, particularly for large-scale or high-temperature industrial needs, where supply and technological readiness above 10 MW remain limited.

Let’s now take a closer look at the key advantages of industrial heat pumps — and how to boost their adoption across sectors.

4. Recovery Strategies & Competitive Advantages

Heat pumps are not only a clean heating solution — they also bring major benefits in terms of energy security, industrial competitiveness, and job creation. In 2024, they supplied over 230 TWh of renewable heat, helping reduce emissions by 72 million tonnes of CO₂. The sector employs around 430,000 people across Europe and includes more than 300 manufacturing sites, many in rural areas, supporting local economies.

To support market recovery, stable and long-term policies are essential. Sudden changes in incentives, combined with economic uncertainty and high electricity prices, have slowed adoption in several countries. A key barrier remains the electricity-to-gas price ratio: when electricity is more than 2–3 times as expensive as gas, consumers struggle to see the economic advantage of switching, despite the higher efficiency of heat pumps.

Policy tools like carbon pricing under the upcoming EU ETS2, and targeted support through the Social Climate Fund (from 2027), are expected to redirect investments toward clean heating technologies. In parallel, new tariff models and smart electricity pricing can improve the economics of heat pumps — especially when combined with demand-side flexibility.

On a strategic level, even modest increases in heat pump adoption can reduce Europe’s dependence on fossil gas. Replacing 7% of gas boilers could cut gas imports by 13 billion cubic metres per year, nearly matching residential imports from Russia.

Finally, innovative business models such as Energy Service Companies (ESCOs) are helping unlock adoption by offering heat as a service, reducing upfront costs and enabling better system integration in large-scale and industrial applications.

5. 2025–2030 Outlook

Europe aims to install 60 million heat pumps by 2030, building on a current base of approximately 24 million units—meaning we are facing a shortfall of around 15 million if annual sales remain at today’s rates.

The industrial segment could play a pivotal role in closing this gap, especially as high-temperature heat pumps (capable of delivering up to 200 °C) become increasingly viable. Achieving this will require sustained investment in R&D, particularly for applications above 150 °C. Moreover, the existing heat pump ecosystem—boasting over 300 manufacturing sites and 430,000 jobs across Europe—provides fertile ground for expansion.

Conclusion

Despite a challenging 2024, the heat pump sector remains a cornerstone of Europe’s energy transition. Sales have slowed due to macroeconomic conditions, unstable policies, and shifting energy prices — but the long-term outlook is strong. Technological progress, particularly in large-scale and high-temperature applications, combined with the strategic role of industrial and district heating, offers solid growth potential.

With over 25 million units installed and 430,000 jobs supported, the industry is well-positioned to scale. Hitting the EU’s 2030 target of 60 million units will require coordinated action: stable incentives, fair energy pricing, continued R&D, and clearer communication on the benefits of heat pumps. Industrial systems should play a key role in closing the gap.

Discover how our heat pumps are the perfect fit for your industry, offering efficient, reliable, and sustainable solutions tailored to your specific needs.

For more information, contact us here. Let’s partner together!

Sources:

European Heat Pump Market Report by the European Heat Pump Association (EHPA): https://www.ehpa.org/wp-content/uploads/2025/07/EHPA-Market-Report-2025-executive-summary.pdf

https://www.ehpa.org/policy-2/repowereu-and-the-eu-heat-pump-action-plan/